wv estate tax return

Tax Return Tax Amendment Change of Address. How long can property taxes go unpaid in West Virginia.

2012 2022 Form Wv Dor Nrsr Fill Online Printable Fillable Blank Pdffiller

TaxAct can help file your state return with ease.

. This final estate tax return is necessary only when an estate is large enough-at least 114 million in assets as of 2019-to require payment of estate taxes related to the. When you die there are many federal and estate tax situations that need to become a priority for those who survive you. Install the signNow application on your iOS device.

The proper forms and instructions will be sent to the fiduciary once the appraisement has been received by the State Tax Department. WV Tax Amendment Form IT-140. Find IRS or Federal Tax Return deadline details.

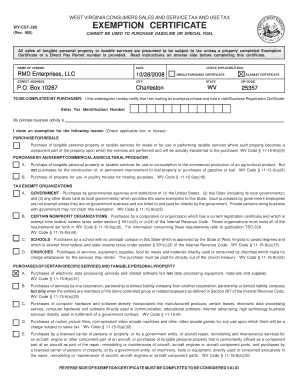

The most secure digital platform to get legally binding electronically signed documents in just a few seconds. The exemption equivalents are. Other Necessary Tax Filings.

Address to which he would return if released from the care facility. In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate Tax Return Form 706. For tax year 2020 the due date for an annual Estate or Trust West Virginia Fiduciary Income Tax return is April 15 2021.

You as executor can file the estates first income tax return which may well be its last at any time up to 12 months after the death. Payment of Additional Estate Taxes in WV. All estates get a 600 exemption.

Ad Looking to file your state tax return. To sign a wv state tax department fiduciary estate tax return forms 2008 right from your iPhone or iPad just follow these brief guidelines. The Department of Revenue administers and enforces West Virginia revenue laws including the regulation of insurance banking and gaming industries as well as.

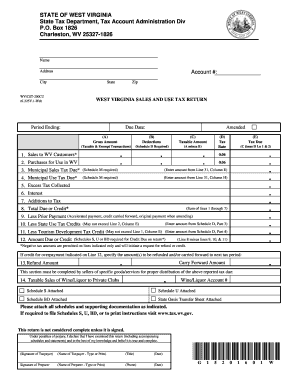

Individuals who have made payments totaling 50000 or more during the most recent fiscal year may be required to file and pay their West Virginia taxes electronically. Create an account using your email or sign in via Google or Facebook. Charleston West Virginia 25324-1071.

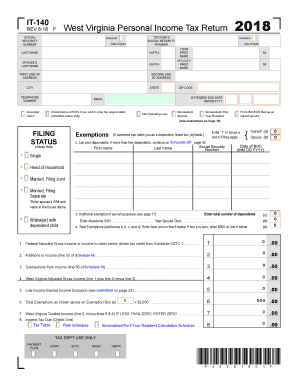

The West Virginia tax filing and tax payment deadline is April 18 2022. Fill out securely sign print or email your wv state tax department fiduciary estate tax return forms 2009 instantly with signNow. Check the Amended return box on Form IT-140.

Under West Virginia law a lien evidenced by a tax certificate of sale cant remain a lien on the real property for a period longer than 18 months after the original issuance of the tax certificate of sale. If you are a non-resident estate or trust having source income use the forms below. You can also deduct.

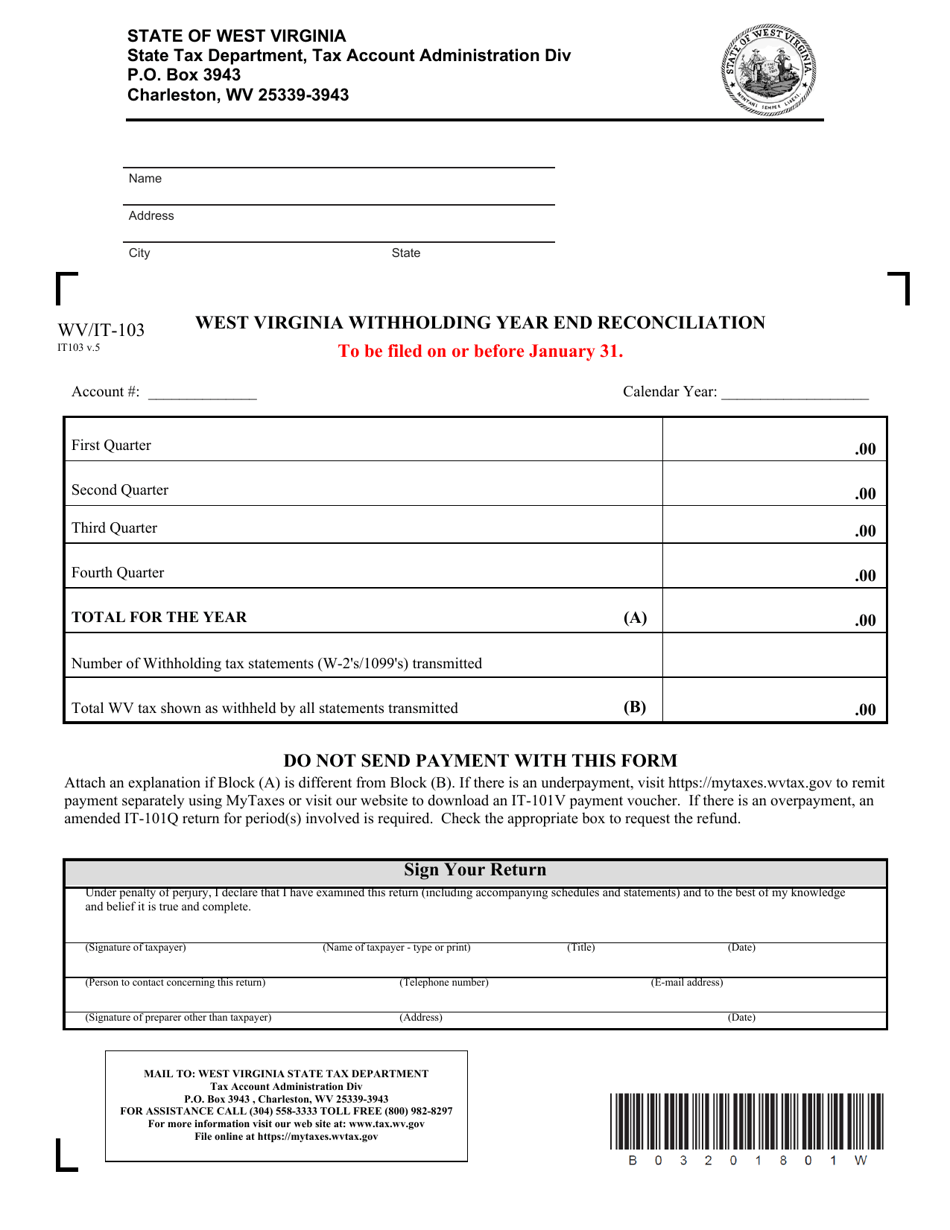

No separate reconciliation is required IT-101Q Employers Quarterly Return of Income Tax Withheld - Form and Instructions IT-101V Employers West Virginia Income Tax Withheld. Download Complete Form IT-140 for the appropriate Tax Year below. Upload the PDF you need to eSign.

13 rows West Virginia wont tax your estate but the federal government may if your estate has. IT-141 Fiduciary Income Tax Return for Resident and Non-resident Estates and Trusts Instructions. Explore state tax forms and filing options with TaxAct.

IT-1001-A Employers Withholding Tax Tables IT-101A Employers Annual Return of Income Tax Withheld. The proper forms and instructions will be sent to the ExecutorAdministrator after the appraisement has been filed. 31 rows Generally the estate tax return is due nine months after the date of death.

Besides the state estate tax you need to look out for the following. This Form can be used to file a. IT-140NRC West Virginia Nonresident Composite Return.

If you file in any month except December the estate has whats called a fiscal tax year instead of a calendar tax year. IT-140NRC West Virginia Nonresident Composite Return IT-141 Fiduciary Income Tax Return for Resident and Non-resident Estates and Trusts Instructions. EFT-WR eFile Electronic Filing and Payment Waiver Request.

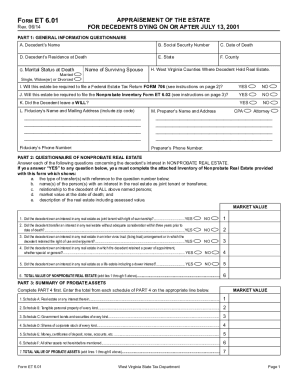

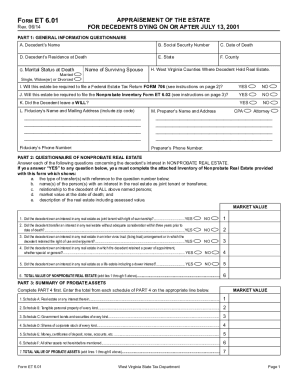

Any estate required to file a Federal Estate Tax Return Form 706 will be required to file a West Virginia Estate Tax Return. Tax Return will also be required to file a West Virginia Estate Tax Return. Start a free trial now to save yourself time and money.

The IT-101A is now a combined form. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a WV state return. I The Internal evenue Service requires the filing of a r Federal Estate Tax return Form 706 for the estate of every citizen of the united States whose gross estate at the time of death was larger than the amount of the federal exemption equivalent.

Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs. West Virginia State Tax Department Tax Account Administration Division PO. The tax period must end on the last day of a month.

There are two kinds of taxes owed by an estate. For decedents dying July 13 2001 and after a release or certificate of non-liability from the West Virginia State Tax Department. If you are a non-resident estate or trust having source income use the forms below.

Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs. Only estates subject to the tax imposed by West Virginia Code 11-11-3 will be issued a release of lien pursuant to West Virginia Code 11-11-17. This page contains basic information to help you.

Here you will find all the information and resources you will need to electronically file and pay your taxes. Most homeowners get around 18 months to redeem the property. Your maximum refund guaranteed.

Payment of any tax balance due may be made by completing the voucher below detaching and mailing to. Final individual federal and state income tax returns the federal and state tax returns are due by Tax Day of the year following the individuals death. HOW AND WHERE TO FILE.

One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax. West Virginia State Income Taxes for Tax Year 2021 January 1 - Dec. Deceased Taxpayers Filing the Estate Income Tax Return Form 1041.

Available for PC iOS and Android.

Wv Cst 280 Fill Online Printable Fillable Blank Pdffiller

Form Wv It 103 Download Printable Pdf Or Fill Online West Virginia Withholding Year End Reconciliation West Virginia Templateroller

2018 2022 Form Wv Dor Cst 200cu Fill Online Printable Fillable Blank Pdffiller

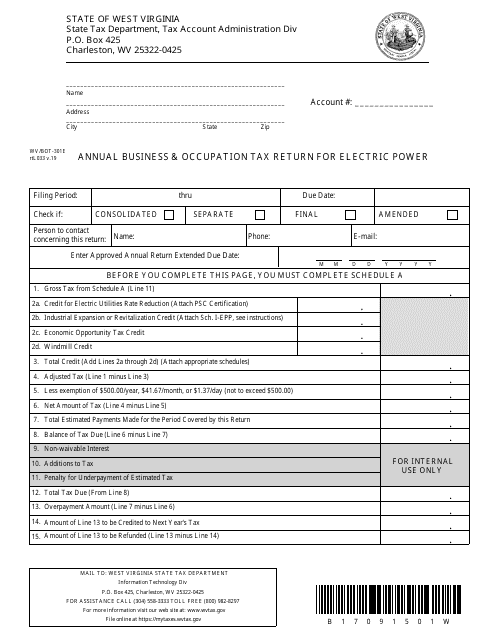

Form Wv Bot 301e Download Printable Pdf Or Fill Online Annual Business Occupation Tax Return For Electric Power West Virginia Templateroller

Form Nrw2 Fillable Statement Of West Virginia Income Tax Withheld For Non Resident Individual Or Organization

Wv W4 Fill Online Printable Fillable Blank Pdffiller

Estate Taxes In Wv Filing A Final Estate Tax Return And Other Responsibilities Blog Jenkins Fenstermaker Pllc

Wv Probate Forms Fill Out And Sign Printable Pdf Template Signnow

Form It 140 Fill Out And Sign Printable Pdf Template Signnow